Accountants are at greater risk

There’s no doubt that accountants everywhere should look at these guidelines as a guide to avoid penalties. But the more important risk that’s worth mitigating is the possibility of a breach itself. Several studies estimate that almost 90% of cyber breaches were the result of human error. When passwords are shared in unsafe ways, or email platforms are not double secured, it puts sensitive client data like banking logins and payroll system passwords at risk.

The industry data suggests that accountants specifically are becoming prime targets for international cyber criminals, intent on stealing identities and sensitive information. You are the custodian of your client banking logins, payroll passwords and taxation information – and as such, you hold an incredible weight of responsibility to protect that data and the way that it’s used.

W-12 information security plan requirement

Practice Protect ensures that you meet and exceed the IRS 4557 guidelines. With over 13,000 active accountants customers worldwide, it has become the industry’s most widely accepted digital security tool. Whether through single sign on functionality, one-click user off-boarding or locked access times and password cloaking for employee groups, Practice Protect puts in place many of the processes that a information security plan includes, simply by deploying it into your accounting firm.

However, an information security plan (or data security plan) is still required in order to satisfy the W-12 PTIN renewal form Question 11. It states:

11. Data Security Responsibilities

I am aware that paid tax return preparers must have a data security plan to provide data and system security protections for all taxpayer information.

In order to tick this box in good faith, an information security plan must exist and be circulated to your entire organization (preferably with training).

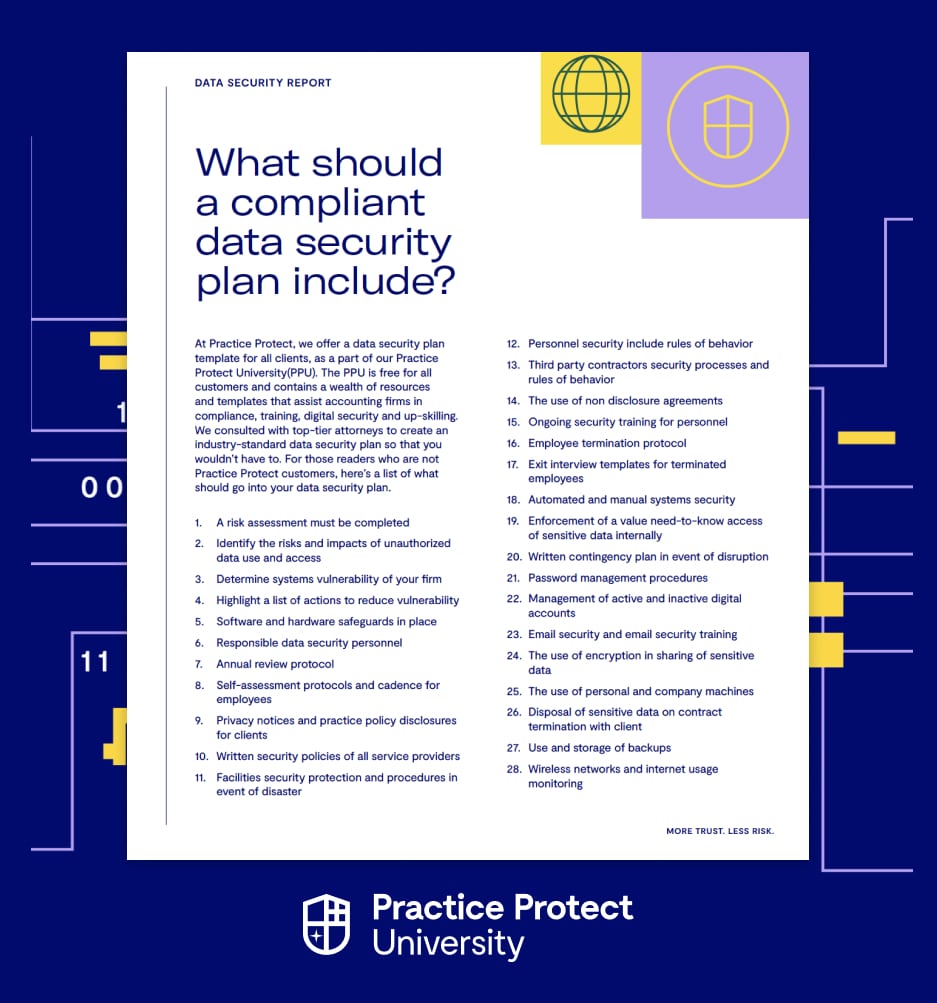

Structuring a data security plan

So what should a compliant data security plan include? At Practice Protect, we offer a data security plan template for all clients, as a part of our Practice Protect University(PPU). The PPU is free for all customers and contains a wealth of resources and templates that assist accounting firms in compliance, training, digital security and up-skilling. We consulted with top-tier attorneys to create an industry-standard data security plan so that you wouldn’t have to. For those readers who are not Practice Protect customers, here’s a list of what should go into your data security planning.

- A risk assessment must be completed

- Identify the risks and impacts of unauthorized data use and access

- Determine systems vulnerability of your firm

- Highlight a list of actions to reduce vulnerability

- Software and hardware safeguards in place

- Responsible data security personnel

- Annual review protocol

Download our guide below to get see the full list.

It includes self-assessment protocols and cadence for employees, privacy notices and practice policy disclosures for clients, written security policies of all service providers, facilities security protection and procedures in event of disaster, and more.

The importance of a Data Security Plan.

All accounting firms in the United States who are tax preparers are required by the FTC Safeguards rule and IRS 4557 guidelines to have in place a data security plan which outlines the protocols and processes which protect customer information and guard against data breaches. This is reinforced by Q11 on the W-12 renewal form. Asking yourself “Do I satisfy the requirements to tick the Q11 box?” is an important question all firms need to ask well ahead of time. There’s other reasons this should become a priority for every accounting firm:

- We know that CPA firms are enticing for cybercriminals because they house tens if not hundreds of financial data sets for companies throughout the USA.

- Hackers often hold stolen information for ransom and this can result in very expensive and stressful recovery pathways for the effected firms.

- Hackers will lock down files, threaten to delete servers of information and cause general havoc internally. Companies going through these situations often have to shut down and cease trading until the matter is resolved.

It’s a lot to take in – the data security report should be both an audit document (allowing you take stock of your situation) and active document (with the processes and protocols in place in the case of an adverse event).

Secure, compliant, and in control - data security and compliance for all

4557 compliant

Password cloaking

Data security docs and compliance policies

Remote & offshore team policy controls

One-Click User Lockout

On call support

Access to training (PPU)

GSuite & Microsoft friendly

Human Powered, AI Supported

Cutting edge technology paired with human-backed support and management

Human Powered, AI Supported

Cutting edge technology paired with human-backed support and management

Secured convenience which works with you

Security protocols flexible to fit your needs and strong enough to protect from threats

Secured convenience which works with you

Security protocols flexible to fit your needs and strong enough to protect from threats

On demand training and documentation

Ensure your staff get the training they need and fulfill insurance obligations

On demand training and documentation

Ensure your staff get the training they need and fulfill insurance obligations

Almost there: please complete the form to request your...

Book Your Free Demo

Nearly there: please tell us where to send your guide...

Accounting Cyber Security Guide 2021

Nearly there: Get your report here

Download the Future of Accounting State of Play Report

Nearly there: Get your report here

Download The Cloud Apps For Accounting Firms Report

Nearly there: Get your guide here

Download The Data Security Report Guide

Nearly there: Get your guide here

Join the Partner Reseller Program

Nearly there: Get your report here

Download The Cloud Apps For Accounting Firms Report

Nearly there: Register here...

and we'll send you the Report at launch

Nearly there: Get your report here

Download The Cloud Apps For Accounting Firms Report

Enter referral details here

Watch Now

On-demand FTC Webinar Registration form

Download The Written Information Security Plan

WISP 2023

Download Now

Download Now

Get Access

Register Now

Download Now

Download Now