Calling all Accountants and Bookkeepers!

All accounting firms in the United States who are tax preparers are required by the FTC Safeguards rule and IRS 4557 guidelines to have in place a data security plan which outlines the protocols and processes which protect customer information and guard against data breaches. This is reinforced by Q11 on the W-12 renewal form. Asking yourself “Do I satisfy the requirements to tick the Q11 box?” is an important question all firms need to ask well ahead of time.

The data security plan should be both an audit document (allowing you take stock of your situation) and an active document (with the processes and protocols in place in the case of an adverse event).

What does our WISP plan include?

At Practice Protect, we’ve built our reputation as America’s largest cybersecurity provider serving over 27,000 accountants. No other provider has as much coal face, real world experience as us when it comes to protecting accounting firms from online fraud and cybercrime.

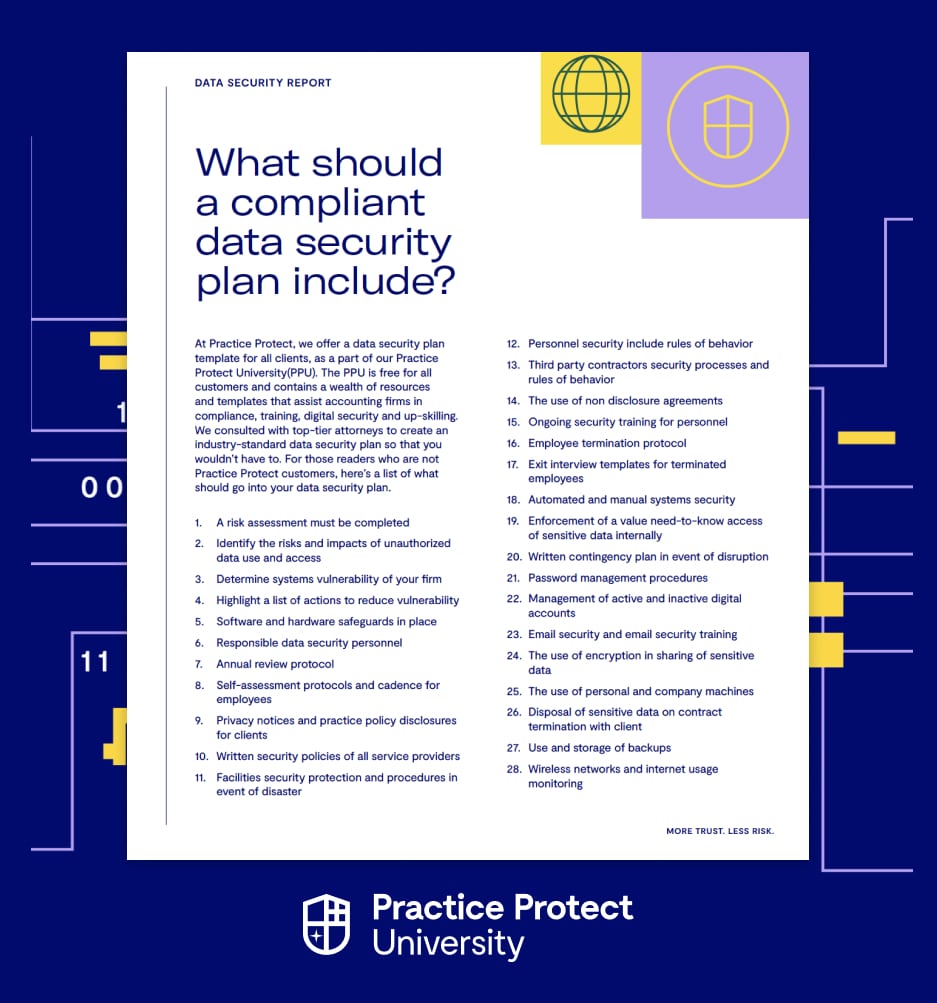

We put together a comprehensive data security plan template. We consulted with top-tier attorneys to create an industry-standard data security plan so that you wouldn’t have to. Here is what it includes –

- Self-assessment protocols and cadence for employees

- Privacy notices and practice policy disclosures for clients

- Written security policies of all service providers

- Facilities security protection and procedures in event of disaster, and more.

Download our WISP below to see the full list.

The importance of a Data Security Plan

The industry data suggests that accountants specifically are becoming prime targets for international cyber criminals with almost 90% of cyber breaches were the result of human error.

This should become a priority for every accounting firm:

- We know that CPA firms are enticing for cybercriminals because they house tens if not hundreds of financial data sets for companies throughout the USA.

- Hackers often hold stolen information for ransom and this can result in very expensive and stressful recovery pathways for the effected firms.

- Hackers will lock down files, threaten to delete servers of information and cause general havoc internally. Companies going through these situations often have to shut down and cease trading until the matter is resolved.

Almost there: please complete the form to request your...

Book Your Free Demo

Nearly there: please tell us where to send your guide...

Accounting Cyber Security Guide 2021

Nearly there: Get your report here

Download the Future of Accounting State of Play Report

Nearly there: Get your report here

Download The Cloud Apps For Accounting Firms Report

Nearly there: Get your guide here

Download The Data Security Report Guide

Nearly there: Get your guide here

Join the Partner Reseller Program

Nearly there: Get your report here

Download The Cloud Apps For Accounting Firms Report

Nearly there: Register here...

and we'll send you the Report at launch

Nearly there: Get your report here

Download The Cloud Apps For Accounting Firms Report

Enter referral details here

Watch Now

On-demand FTC Webinar Registration form

Download The Written Information Security Plan

WISP 2023

Download Now

Download Now

Get Access

Register Now

Download Now

Download Now

Download Now