Hubdoc vs. Dext: The Top Cloud Apps Transforming Expense Management

Keeping track of expenses, client transactions, receipts, and invoices is taxing in a dynamic market and fast-moving business climate. Having to stay on top of managing expenses, accountants and bookkeepers face this mounting challenge daily. As firms and businesses scale, the complexities of expense management grow bigger, which often leads to financial discrepancies and the likelihood of human error. Featured in the 2024-2025 Cloud Accounting Report, cloud-based software like Hubdoc and Dext are transforming expense management this year, helping accounting professionals streamline processes and improve financial data accuracy.

Streamlining Expense Management in an Era of Digitalization

Piles of paperwork coupled with disorganized filing systems slow down the workflow of accountants and bookkeepers. They are expected to handle more transactions and receipts daily, which causes delays in approval and reconciliation, especially with manual entry and outdated record-keeping processes.

In the quest to improve workflows, accountants have moved to cloud-based solutions for expense management. This helps firms to enhance accuracy in records as well as simplify the documentation of expenses with automation.

With advancements in technology, artificial intelligence (AI), and data automation, traditional expense management methods could cease to exist. The old-school way of doing things will likely be outpaced by cloud-based applications that continuously invest in making this process less painful and uncomplicated.

In terms of accuracy, speed, and overall efficiency for accountants and bookkeepers, cloud applications for expense management enable them to focus more on high-value tasks with a streamlined workflow.

Hubdoc vs. Dext: Top Players Based on the 2024-2025 Cloud Accounting Report

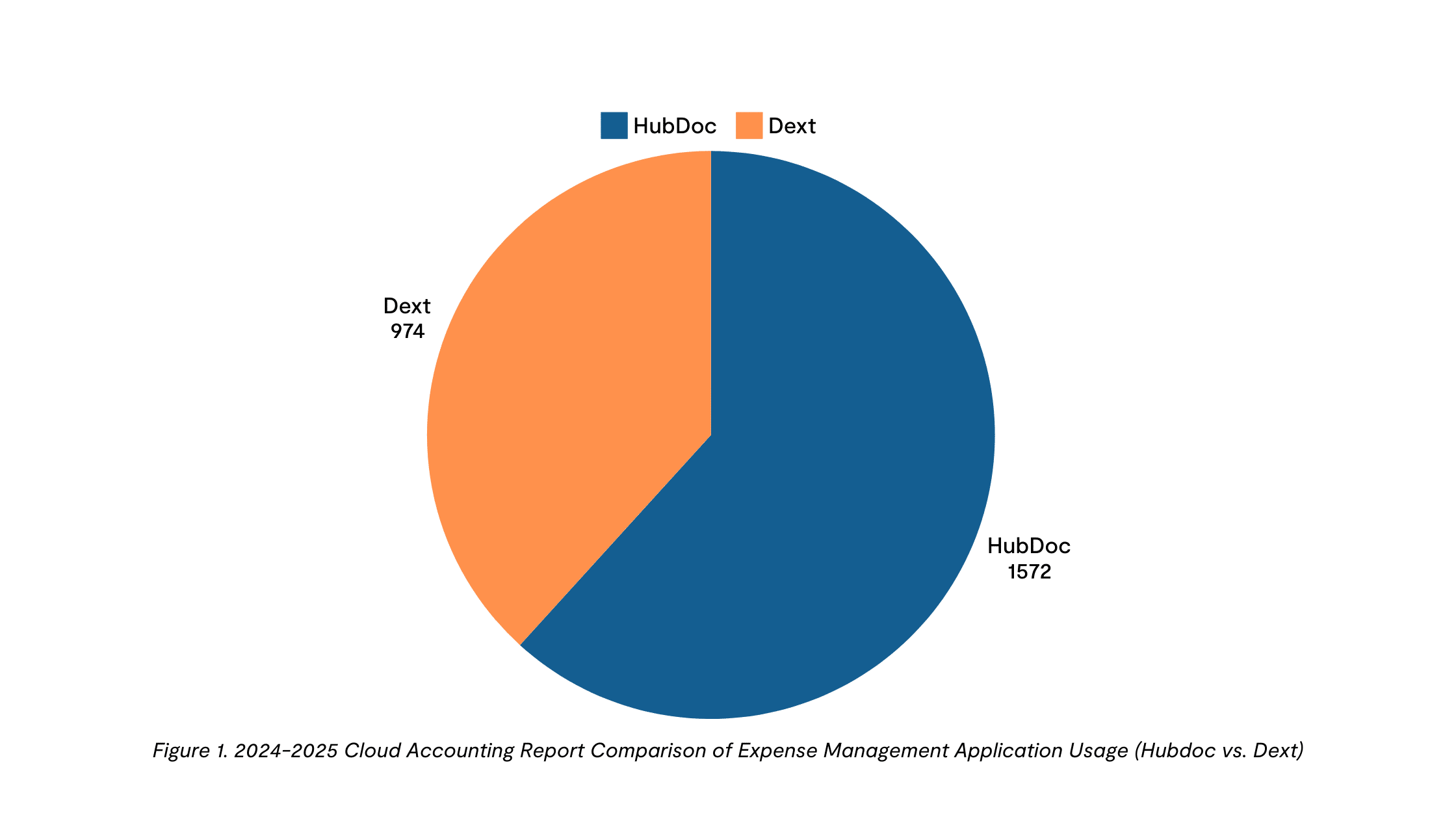

In Practice Protect’s Cloud Accounting Report for 2024-2025, Hubdoc and Dext have emerged as the two leading cloud applications for expense management. Hubdoc maintains its edge this year, surpassing Dext by more than 594 users, as shown in the report’s data.

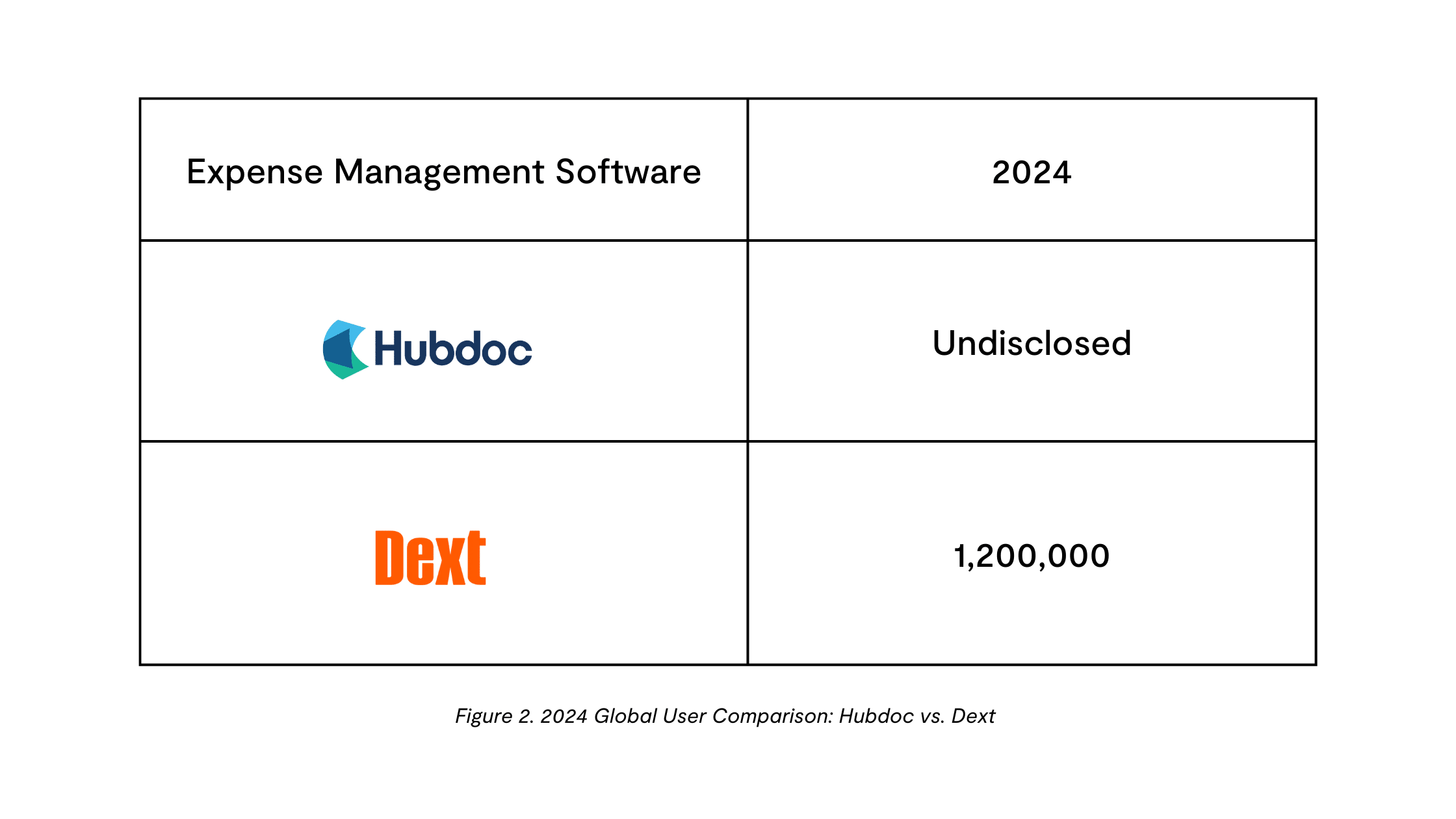

However, on a global scale, Dext holds the overall lead with over 1.2 million users, supporting approximately 700,000 businesses.

Looking ahead, Hubdoc, owned by Xero, is expected to increase its investment in this space, which could also show impressive growth in the coming years.

Both platforms have unique features, advantages, and unfortunately, some limitations that can influence their suitability for accounting and bookkeeping firms. Let’s take a closer look beyond the report to understand how each platform stands out and how it can work for your firm.

Hubdoc At a Glance: Turning Paperwork into Digital Data You Can Use

Hubdoc is popular among small to medium-sized businesses (SMBs) with lower transaction volumes. This makes it ideal for firms looking to have an easy-to-use platform for automating data capture and document management with clients across the SMB market.

Hubdoc simplifies data entry, by extracting vendor names, invoice numbers, and amounts from receipts and other data on invoices, reducing the time spent on manual entry. Users can do this just by taking a photo using their mobile application or directly uploading scanned documents. Further, this document and data capture platform allows easier collaboration with its platform integrations. Thus, accountants and bookkeepers are both in the loop regarding transactions. With Hubdoc’s automatic backup and cloud syncing, you can bid adieu to data silos.

Its seamless integration with Xero facilitates real-time syncing of documents and financial data, making it particularly beneficial and desirable to existing Xero users.

Overall, Hubdoc provides a straightforward cloud-based expense management solution, perfect for firms seeking simplicity without the complexities of more advanced document management software.

Dext in Focus: Automated Bookkeeping for Real-time Flow

Dext matches up with Hubdoc, as one of the leading apps in the expense management category in the 2024-2025 Cloud Accounting Report.

Dext prides itself on its advanced data capture technology, offering 99% accuracy of data extraction powered by Optical Character Recognition (OCR). This grants complete and real-time data capture, and significantly minimizes the likelihood of errors in financial data entry, allowing bookkeepers to record expenses and capture invoices right after a transaction occurs.

Using OCR technology, Dext converts physical documents into digital data and provides flexibility with multiple submission methods, wherein users can send receipts and invoices through mobile scanning, email, and direct bank feeds. A quick snapshot of receipts, invoices, and bank statements can be uploaded to Dext’s application for easy data extraction.

In addition to the above, Dext does more than just pull out data; it can automatically categorize and code expenses using AI and machine learning. Bookkeepers can establish custom rules making workflows faster and more adaptable. Up-to-date financial records help accountants monitor cash flow effectively, thereby putting greater focus on compliance and improved business forecasting, both of which are enhanced by the platform’s features.

Moreover, Dext integrates with over 30 accounting software platforms and connects with more than 11,500 financial institutions worldwide. This extensive integration network allows accountants and bookkeepers to streamline their operations and work within the systems they are already familiar with.

Choosing the Best Fit for Your Firm

Cloud-based and AI-powered platforms are becoming the go-to choice for expense management, leaving the traditional method of manual data entry obsolete and less reliable over time.

With innovative tools like Dext and Hubdoc, accountants and bookkeepers can spend less time on administrative tasks and focus more on their firm and core responsibilities. While both leading platforms offer unique features to streamline bookkeeping processes and automate routine tasks, the best choice ultimately depends on your organization’s specific needs.

To make an informed decision about the best expense management tool for your firm, read the Cloud Accounting Report 2024-2025, which provides insights on the user growth of these cloud applications.