The Rise and Fall of Electronic Signature Software

The software accountants use can make, or break, their firm, and one of the heavy lifters in this space is the E-signature software. This software is helping to power many firms through simplifying and improving the way they handle contracts, tax documents, and, well, all manner of documents throughout the firm.

Thanks to our latest annual report – The Cloud Accounting Report – we have got insights into what applications accountants use on a daily basis. It is clear accountants have their favorite tools when it comes to e-signature.

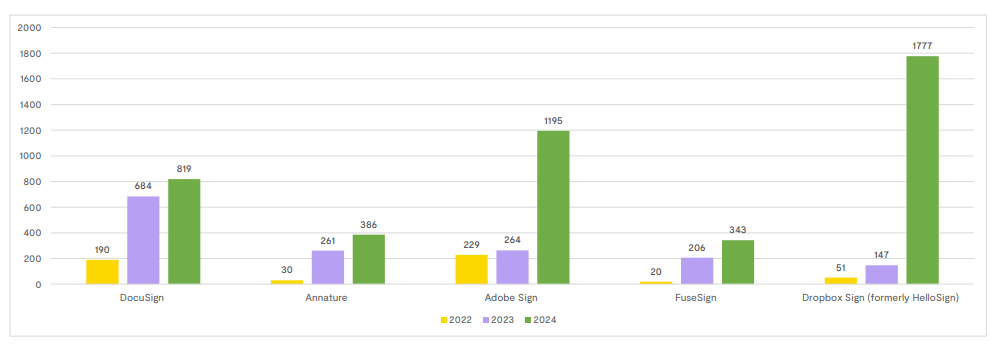

Some key stats about E-Signature Software in this year’s report:

- 189% growth in electronic signature usage over the last 12 months

- Over 4,5000 users are actively using e-signature software

- 1,109% growth for Dropbox Sign

Across the tools we see that Dropbox Sign is by far the most popular, this is being driven by the heavy adoption of QuickBooks Online. Whereas the Adobe Acrobat Sign tool is being driven by the growth of Xero, who has adapted it into their Xero Sign tooling.

But what about the others? Annature and FuseSign, two Aussie success stories continue their growth but fall behind the major players. Both tools developed especially for the more regulated industries such as Accounting set the bar when it comes to the client and user experience.

But, although they are coming from behind in this David and Goliath story there are some really big things that make these two really stand out from the competition – compliance. Both these tools focus not just on a great client experience they also put safety, trust, and compliance at the forefront.

With the unique ability to upload and verify the signatory FuseSign and Annature could soon be the industry standard for the accounting profession. Especially as they provide this as a core part of their offering rather than enterprise-grade like most other e-signature providers.

When it comes to e-signature who are you going to trust for your firm – the industry heavyweights or the software made for accountants by accountants?

Want to read the report for yourself?