PTIN Renewal 2023 – A Quick & Simple guide for accountants

Are you a tax professional preparing for your PTIN renewal in 2023? Renewing your Preparer Tax Identification Number (PTIN) is crucial, but that’s not the only aspect to consider. The IRS has introduced new guidelines, including IRS 4557, emphasizing the importance of data security for tax preparers in the United States. In this quick and simple guide, we’ll not only cover the PTIN renewal process but also delve into your data security plan to ensure compliance with IRS 4557.

What is a PTIN?

A PTIN, or Preparer Tax Identification Number, is an essential credential for tax professionals. However, it’s not just about the number itself; it’s about your ability to assist clients with their tax matters and represent them before the IRS. Ensuring you have a valid PTIN is the first step towards a successful tax practice.

Why is it Important to Renew My PTIN?

Failing to renew your PTIN in a timely manner can have significant consequences. Firstly, you’ll lose your eligibility to prepare tax returns for clients, potentially impacting your practice’s revenue. Secondly, non-compliance with PTIN renewal can lead to legal penalties and disciplinary actions by the IRS. Renewing your PTIN is not just a requirement; it’s a commitment to maintaining your professional standing in the tax industry.

When is the PTIN Renewal 2023 Deadline?

Mark your calendar with a crucial date: the PTIN renewal deadline for 2023. The IRS typically opens the renewal period in October, and tax professionals must renew their PTINs by December 31st of each year. Missing this deadline can result in lapses in your ability to practice, so set a reminder and renew promptly.

Why is Data Security Vital for PTIN Renewal in 2023?

With the release of IRS 4557 guidelines, data security has taken center stage in the world of tax preparation. These guidelines outline specific requirements for securing sensitive client data. Failure to comply can lead to serious consequences, including legal penalties and reputational damage. Data breaches can be devastating, both financially and professionally.

How to Renew My PTIN in 2023?

Renewing your PTIN for 2023 is a straightforward process. The IRS offers both online and mail-in renewal options. Here’s a step-by-step guide:

Online Renewal:

- Visit the IRS PTIN system website.

- Log in to your PTIN account.

- Review and update your information, including any changes to your personal details or professional status.

- Pay the PTIN renewal fee online.

- Receive your renewed PTIN instantly.

Mail-in Renewal:

- Download Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal.

- Fill out the form with your updated information.

- Include a check or money order for the PTIN renewal fee.

- Mail the completed form and payment to the IRS address specified in the instructions.

- Await your renewed PTIN by mail.

Don’t forget to double-check your information for accuracy to avoid processing delays.

What is an IRS WISP or a Data security plan?

A Data Security Plan or Written Information Security plan (WISP), as required by the IRS, is an essential component of PTIN renewal in 2023.

A WISP is a comprehensive document that outlines an accounting firm’s security controls, processes, and policies. Think of it as a roadmap for your firm’s IT security. It provides clear guidelines on how to safeguard sensitive data, prevent security breaches, and respond effectively in case of a cyber incident.

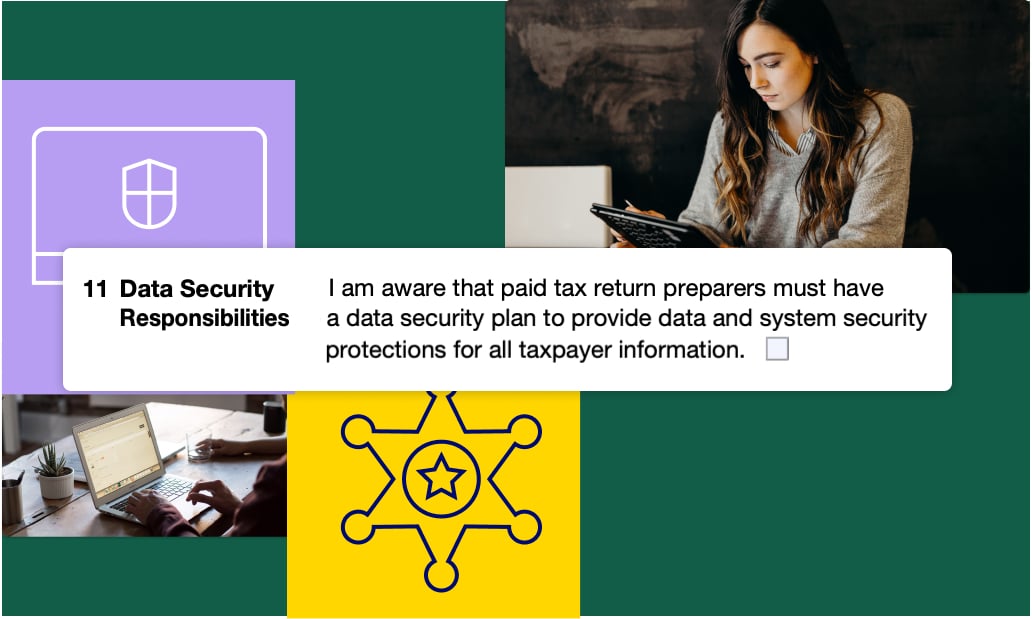

Specifically outlined in the W-12 PTIN renewal form, Question 11, it states:

Question 11. Data Security Responsibilities

“I am aware that paid tax return preparers must have a data security plan to provide data and system security protections for all taxpayer information.”

To affirm this statement in good faith, tax preparers must have a comprehensive data security plan in place, circulated throughout their organization, and ideally coupled with training.

How to create your WISP or Data Security Plan?

At Practice Protect, we offer WISP template packs for all clients, as a part of our Practice Protect University (PPU). The PPU is free for all customers and contains a wealth of resources and templates that assist accounting firms in compliance, training, data security and up-skilling. We consulted with top-tier attorneys to create an industry-standard data security plan so that you wouldn’t have to.

For those readers who are not Practice Protect customers, here’s a list of what should go into your WISP –

- A risk assessment must be completed

- Identify the risks and impacts of unauthorized data use and access

- Determine systems vulnerability of your firm

- Highlight a list of actions to reduce vulnerability

- Software and hardware safeguards in place

- Responsible data security personnel

- Annual review protocol

- Download our guide below to get see the full list.

It should include self-assessment protocols and cadence for employees, privacy notices and practice policy disclosures for clients, written security policies of all service providers, facilities security protection and procedures in event of disaster, and more.

WISP & Data Security plan templates

Finding it overwhelming to create a WISP on your own? We are here to help you along the way. For non-Practice Protect clients, we offer free WISP template pack that will include accounting specific and ready-to-use templates for –

- Information Security Plan

- Incident Response Plan

- Risk Assessment Matrix

This template pack will help you breeze through your WISP in 2 hours. Join our workshop to get access.

WISP Workshop

Calling all accountants and tax preparers – Say goodbye to countless hours and unnecessary costs with our pre-populated, user-friendly Written Information Security Plan (WISP) pack.

Watch our exclusive on-demand WISP workshop to discover a simplified path to crafting your Written Information Security Plan.

In this workshop, we will cover

- The Ready-to-Use ISP Pack, featuring a WISP, Incident Response Plan, and Risk Assessment Matrix.

- Step-by-step guidance on harnessing these pre-populated templates for your firm.

- Technology and systems to implement for a seamless WISP completion.

Join this informative session and to get access to a fully implementable information security plan.